FamApp guide in 2025

: FamApp kya hai?

: FamApp kya hai?

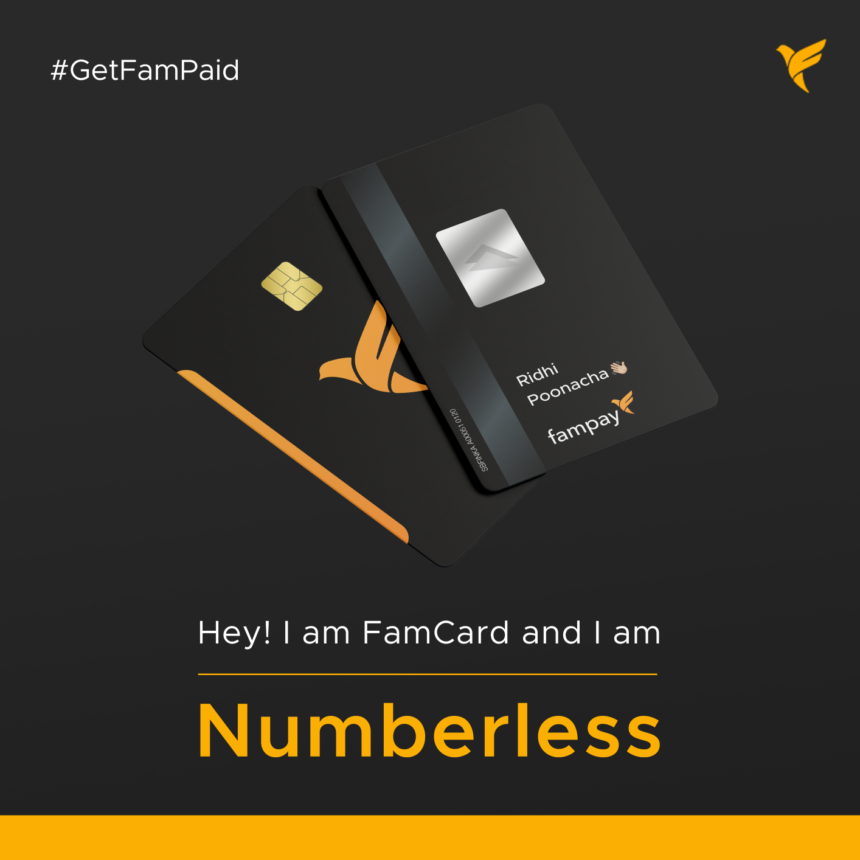

FamApp guide in 2025 :FamApp ek neo‑banking fintech platform hai jise 13+ saal (11+ for basic) ke teenagers aur Gen Z ke liye banaya gaya hai . Isme users apna FamX Spending Account kholte hain — jisme UPI ID aur numberless FamCard (prepaid RuPay card) hota hai — bina bank account ke!

SEEKHEN FamApp

✅ Key Features (Aur kaise use karein)

1. 🔐 Numberless FamCard

-

Physical card par koi number/CVV nahi hota; saari details secure app ke andar hi stored hoti hain

-

Agar card kho jaye, toh pause/block mode easily enable ho sakta hai

2. UPI & QR-Based Payments

-

Har user ko apni custom UPI ID milti hai, jise QR scan karke instant pay kar sakte hain

-

QR themes bhi customise karne ke options available hain

3. Tap & Pay Features

-

Contactless tap‑and‑pay supported via FamCard – offline spending fast aur smooth

4. Prepaid Model & FamPool

-

Account prepaid hota hai: bachche sirf parents dwara preload ki gayi money hi use kar sakte hain

-

FamPool feature ke through family ke multiple min‑users add karke shared balance manage kar sakte hain

5. Parental Controls

-

Parents spending limits set kar sakte hain, real‑time transaction alerts paate hain, aur full transaction history track kar sakte hain

6. Rewards & Cashback

-

Har transaction par cashback + FamCoins milte hain, jo gift cards ya discounts ke form me redeem ho sakte hain

-

In‑app games and spinners se extra rewards jeetne ka chance bhi hota hai

7. DigiGold (Investments)

-

App ke andar users ₹10 se bhi DigiGold mein investment kar sakte hain

8. FamCard Customization & Gamification

-

Card design apnaise customise karo: doodles, personalized naam, etc.

-

App me gamified savings challenges hote hain jisse bachche aur engage hote hain

FamApp guide in 2025 :🛡️ Safety & Security Measures

-

Encryption + 2FA/biometric protection har transaction pe enabled hota hai (fingerprint, face‑ID, PIN)

-

Numberless card ke wajah se printing fraud risk almost zero hai Flash PIN generate hota hai har transaction ke liye, bina OTP ke bhi approve ho jaata hai

-

Users koi bhi suspicious payment notice karein, toh 48‑hour wait re‑attempt aur automatic refund policy follow hoti hai

👨👩👧👦 Parents ke liye Benefits

- FamApp guide in 2025:

-

Pocket money directly transfer karo, no cash handling needed.

-

Transparency with control via limits + full viewing of wallet balance & transactions

-

Practical financial literacy: budgeting, saving, banking basics seekh pate hain bachche.

-

24×7 customer‑support available for parents & teens

🚀🚀 Kaise download Karein?

!

!

FamApp guide in 2025:

-

Download the app: Android/iOS par “FamApp by Trio” search karein.

-

Mobile number verify → KYC with minor/adult details (Aadhaar, guardian PAN)

-

Order FamCard (₹100‑₹200 fee, delivery in 10‑14 working days)

-

Parent preload money aur set limits — bachche enjoy kar sakte hain khud ki pocket money responsibly!

https://youtube.com/shorts/fKS3T3S3B_4?si=LGB4zW8a_ofE6mmw

Famcoins ko kaise use karen

-

Offers & discounts: In-app Rewards section se coupons, gift cards activate karo

-

Giveaways/spinners: FamCoins se lucky raffles ya spin‑and‑win games me participate karo

-

Charity donations: Coins donate karke social causes support karo

https://youtube.com/shorts/5NLpU5RYslg?si=SW2611LceTKex9WB

🟡 DigiGold in FamApp — Kya hai aur kaise kaam karta hai?

1. Spin & Earn Gold

-

App ke Offers ya Gold section mein aap “Spin the Wheel” feature use karke ₹2–₹50 worth of digital gold jeet sakte ho . Yeh gold seedha aapke digital locker me add ho jayega.

2. Buy/Sell Digital Gold

-

Aap chhoti amount se digital gold buy kar sakte ho—₹10 se bhi shuru, vault mein stored hota hai via partner like Augmont.

-

Gold ka buy–sell price hamesha spread ke saath hota hai—buy price slightly higher, sell price lower—ye intermediary margin ko cover karta hai .

3. Secure Vault Storage

-

Gold insured vaults mein securely store hota hai; Augmont jaise trusted players ke through manage hota hai.

-

Aap future me apni digital gold ko physical coin/bar mein convert bhi karwa sakte ho aur doorstep delivery le sakte ho.

4. Transparent Pricing & Spreads

-

Buy price > market, sell price < market—yeh spread hai, jis se small commission jata hai for service.

-

Iska matlab hai agar aap gold beetenge, toh thoda kam paisa milega—and buying pe thoda extra cost lagega. Yeh commodity trading ka standard tariqa hai.

⚠️ Reddit User Feedback on DigiGold

“I have to pay 3% GST on every purchase and the sell price is around 4% lesser than market price.”

-

Iska matlab hai purchase + sale pe fees lagti hai, jisse returns ka thoda margin kam ho jaata hai.

-

Har koi investor advice karta hai ki yeh long-term piggy bank ke liye ho sakta hai, lekin agar serious growth chahiye, toh Sovereign Gold Bonds ya bank RD best hote hain.